Our News & Articles

Firm Forward: Launching Our Enhanced Newsletter Series for Legal Insights and Updates (Apr24)

Legal Lens: MIC Adopts Flexible Approach for Export-Oriented Investment Tax Incentives (Apr24)

Legal Lens: Suspension of Writ Applications During the State of Emergency (Apr24)

Success Stories: Restructuring Offshore Loan Repayment Amidst Financial Challenges (Apr24)

“ After decades of structuring complex energy projects and infrastructure finance across ASEAN, it is my vision to establish a team of lawyers and business professionals that take pride in helping clients grow their business. We provide a full range of legal and business services, but we really excel in resolving difficult matters that require creative solutions. ”

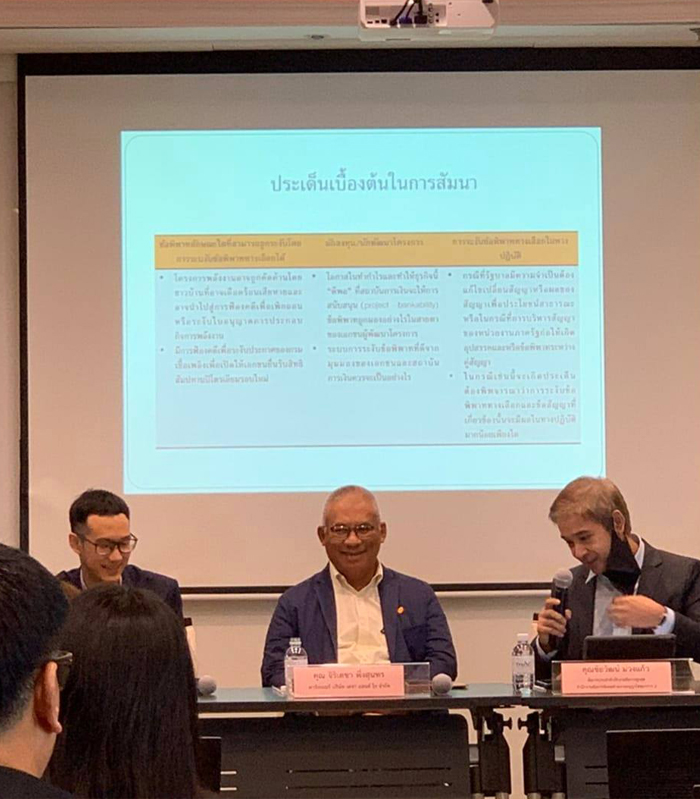

— Chiridacha Phungsunthorn, Partner

Our Focus

Energy, Utilities, Mining, Oil and Gas

Finances, Securities Banking, Insurance

Information and Communication technology

Consumer Products and Retail Distribution

Property and Construction

Health Care Services, Cannabis Regulation and Licensing

Agro and Food Industries

Logistics